Billionaire Mark Cuban became the target of a wallet hack, resulting in the unfortunate loss of around $870,000 worth of cryptocurrency.

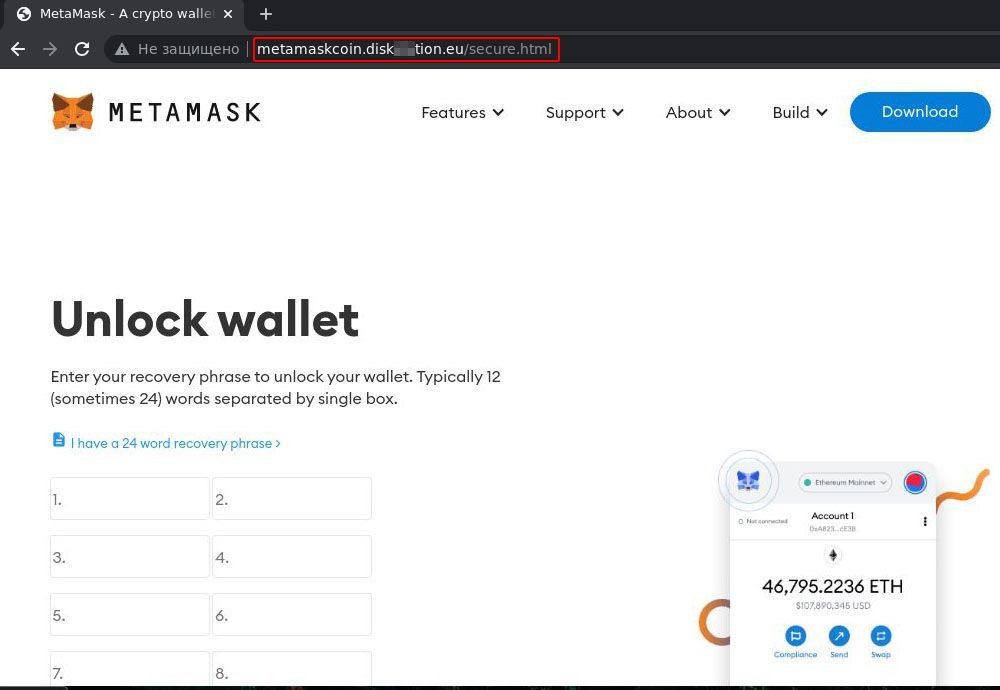

On the 15th of September 2023, billionaire Mark Cuban became the target of a wallet hack, resulting in the unfortunate loss of around $870,000 worth of cryptocurrency. It appears that the entrepreneur may have fallen into a scam where he downloaded a fake and fraudulent version of the widely used browser-based MetaMask cryptocurrency wallet.

Despite the incident, the entrepreneur successfully retained his cryptocurrency holdings on the Polygon (MATIC) network. However, his wallet suffered stablecoin losses: Lido staked ETH, SuperRare assets, and Ethereum Name Service (.ens domains) tokens, which were drained.

The hack was first noticed by the X user @WazzCrypto. Wazz shared screenshots of crypto wallets associated with Cuban, revealing a series of Ethereum (ETH) transactions, raising concerns of suspicious activity. An additional $2 million worth of USDC was transferred to a distinct wallet shortly after, prompting Wazz to entertain the possibility that Cuban might have been engaged in asset repositioning.

Lmao, did Mark Cuban's wallet just get drained?

— Wazz (@WazzCrypto) September 15, 2023

Wallet inactive for 160 days and all assets just moved pic.twitter.com/vWnMZFyHB5

Nevertheless, a few hours later, Cuban officially disclosed to a news portal that he had accessed MetaMask for the first time in months. He alluded to the notion that the hacker or hackers could have been monitoring his activities and patiently waiting for the opportune moment to strike. Although he insinuated that the hack may have been a result of someone monitoring his online actions, it is more likely that he fell into this common scam, downloading a fake version of the MetaMask wallet. That's a simple scam, and many people have been a victim for their lack of experience or inattention.

Dishonest actors frequently develop fraudulent MetaMask extensions to deceive users into disclosing their private keys or seed phrases. Once these malicious actors obtain access, they can easily steal user's assets. Cuban has experienced crypto losses before. In 2021, when the TITAN stablecoin from Iron Finance fell apart in what appeared to be a scam, he lost some of his assets, although the exact amount wasn't disclosed.

What are the most common scams?

Alongside the great opportunities of the crypto market, there are also a variety of scams and fraudulent activities in it. The best weapon to protect yourself in this environment is knowledge, conducted through serious research. Cypherpunktimes.com is one good example of a place to get the best market information, with articles, podcasts, videos, and hard news.

2022 was the year when the crypto community faced a record of U$3.8 billion worth of coins stolen. Against this backdrop, it's crucial to be aware of the various scams that infest the crypto market. Here are some common crypto scams to watch out for:

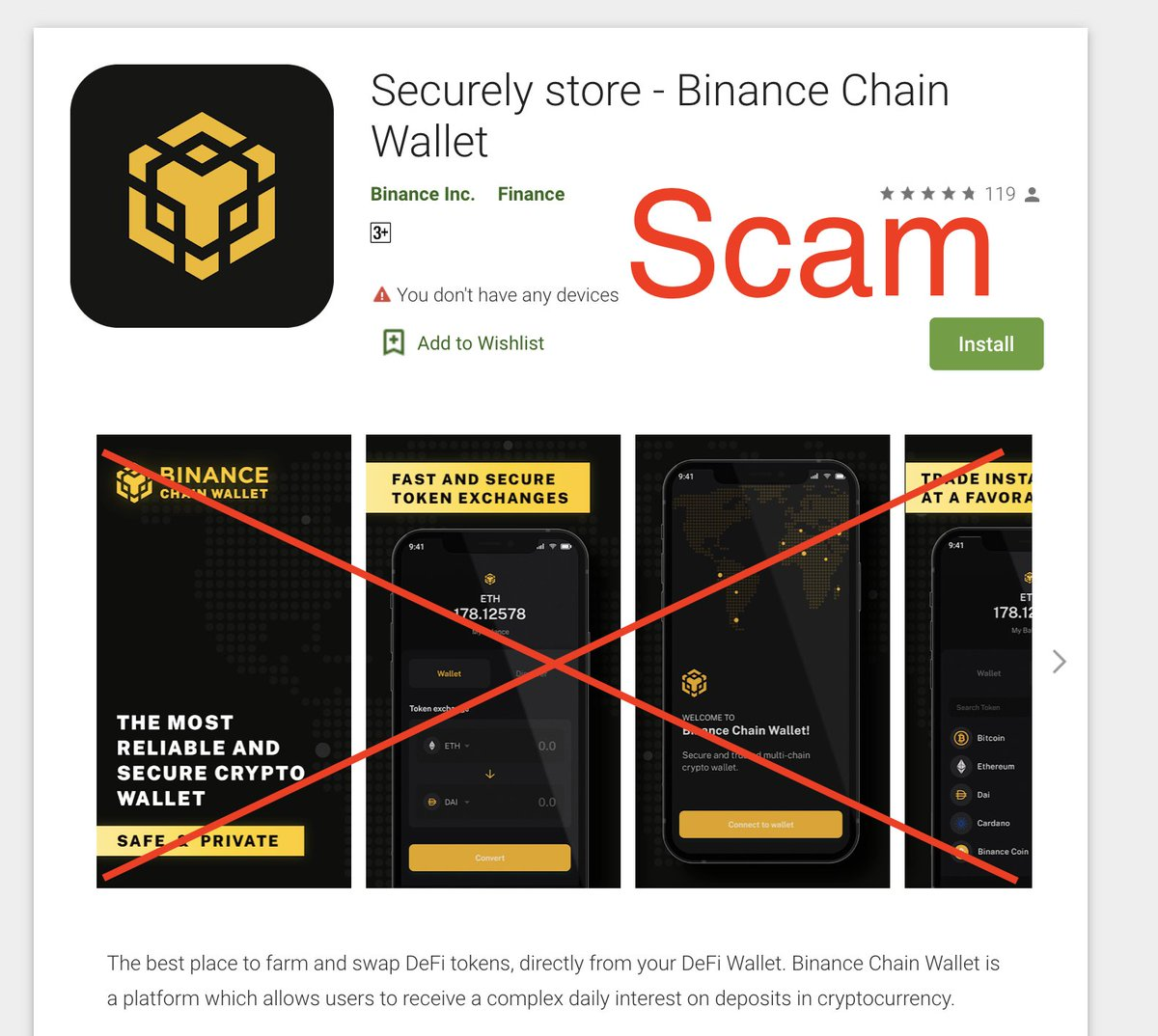

1- Fake Exchanges and Wallets: Just like the scam that Mark Cuban fell into. There are fraudulent crypto wallets and exchanges designed to look convincing, but designed to trick you and steal your coins. Make sure to always verify the legitimacy of a wallet or exchange before using it. Always check the truthfulness of the links where you are going to download them! Also make sure to stick to reputable and secure platforms, such as Decrediton Wallet, and DCRDEX.

2- Phishing Scams: This is one of the most common scams, where investors are tricked into revealing their private keys/seeds by posing as legitimate services or companies. Scammers send deceptive emails or messages with programs that aim to steal your confidential information. Remember to never open links from unknown/suspect senders.

3- Fake Social Media Giveaways: It's common to see fake Elon Musk profiles talking about Bitcoin giveaways. Even those being obvious scams, some people still send them crypto to participate in the so-called giveaways, but winners never receive any rewards. Avoid at all costs these fake opportunities, where money is offered with no counterpoint.

4- Pump and dump schemes: This type of scam unfolds when a collective of individuals collaborate to lure others into investing in a specific cryptocurrency. Typically, they employ social media platforms to generate excitement and anticipation around the coin. As part of their strategy, scammers collaborate to artificially boost the coin's price. Then, in a coordinated move, they all sell off their holdings, leaving unsuspecting new investors with significant losses. To avoid these scams remember to study a project and check its viability before investing, and always stick to trustworthy projects, that are truly creating something.

Education and vigilance are your best defenses against crypto scams. The market is a very free space, there are good and bad consequences about this aspect! Consider meeting people in this enviroment, being part of a crypto community or group will keep you informed about the latest opportunities and dangers that are going on.

Comments ()