October 2023 roundup of all things crypto and what’s happening in the cryptocurrency realm. What was your biggest news piece?

A monthly roundup of all things crypto and what’s happening in the cryptocurrency realm

- Coinbase granted full license in Singapore

- UBS taps Ethereum to pilot tokenized money market fund

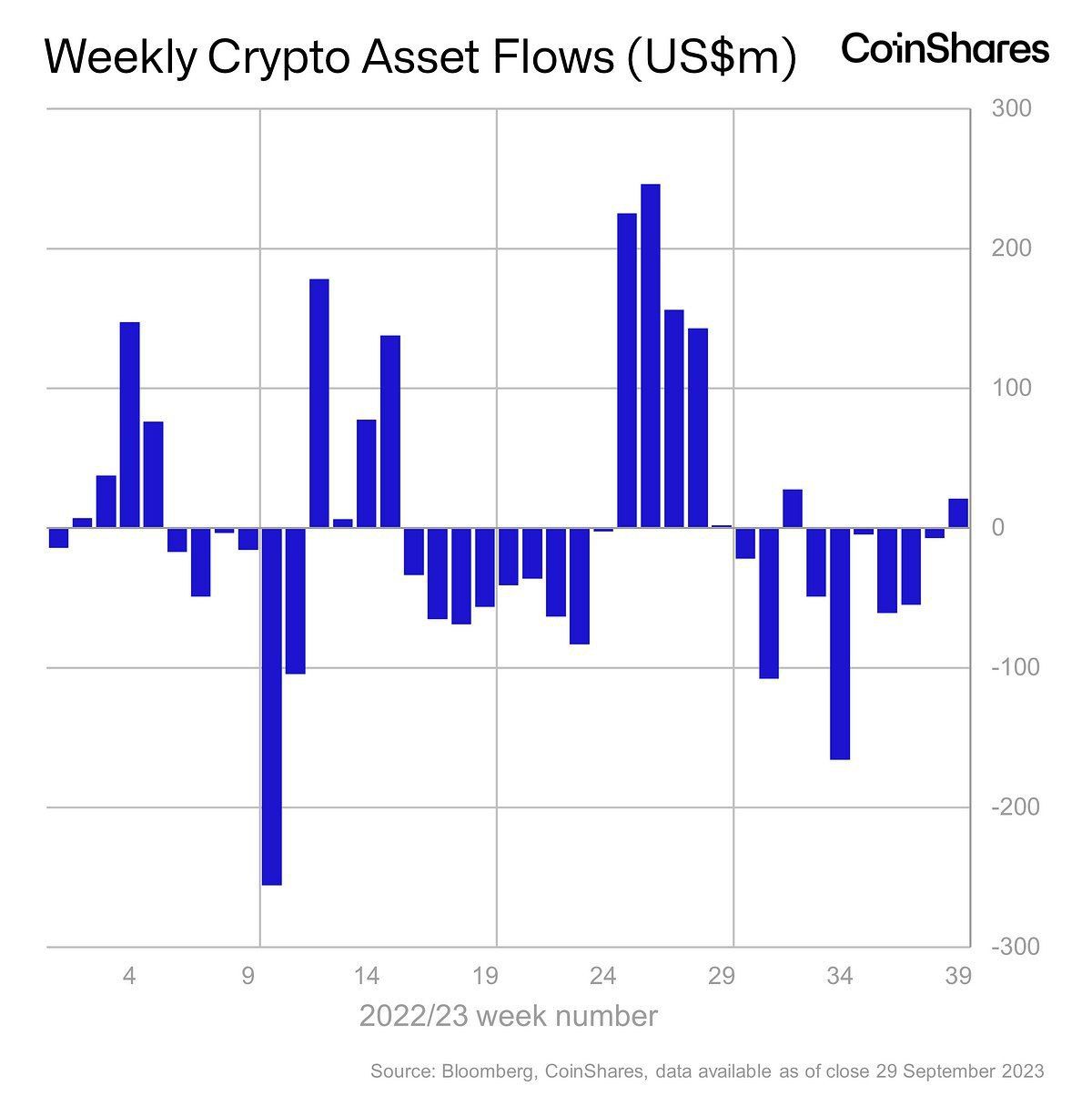

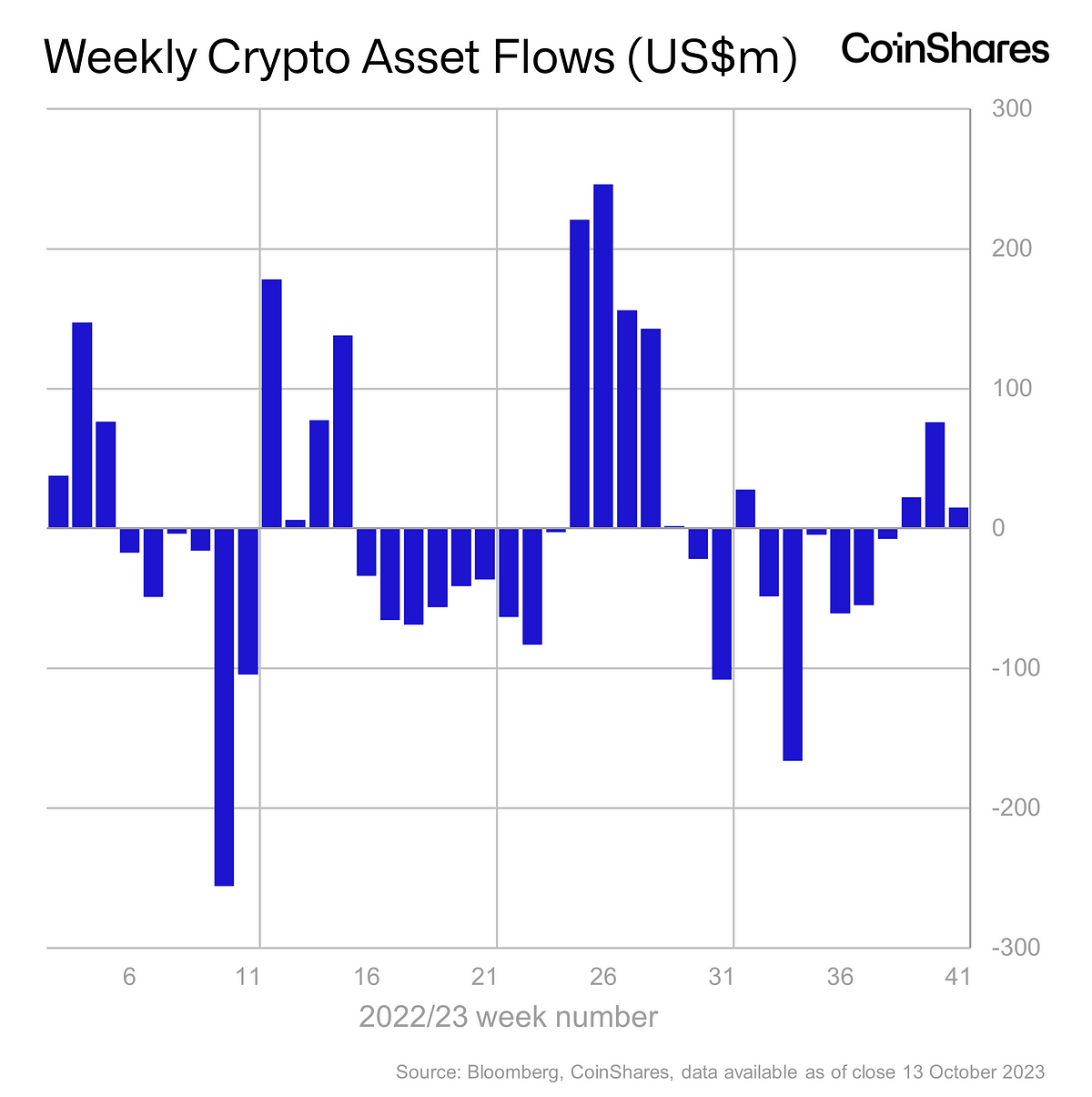

- Digital asset investment products saw inflows last week for the first time in 6 weeks totalling $21m

- Grayscale moves to convert its Ethereum trust to a spot ETH ETF

AND THEY'RE OFF.. Ether Futres Derby underway.. VanEck in a slight early lead, altho looks like a few of them not out of gate yet, will post updates as we go.. pic.twitter.com/lzfD4FCTnn

— Eric Balchunas (@EricBalchunas) October 2, 2023

- Three Arrows co-founder Zhu Su arrested in Singapore, sentenced to 4 months’ prison

- Celsius seeks court approval to start repaying customers by year-end

- Jump Trading lost more than $200 million in FTX collapse: Going Infinite

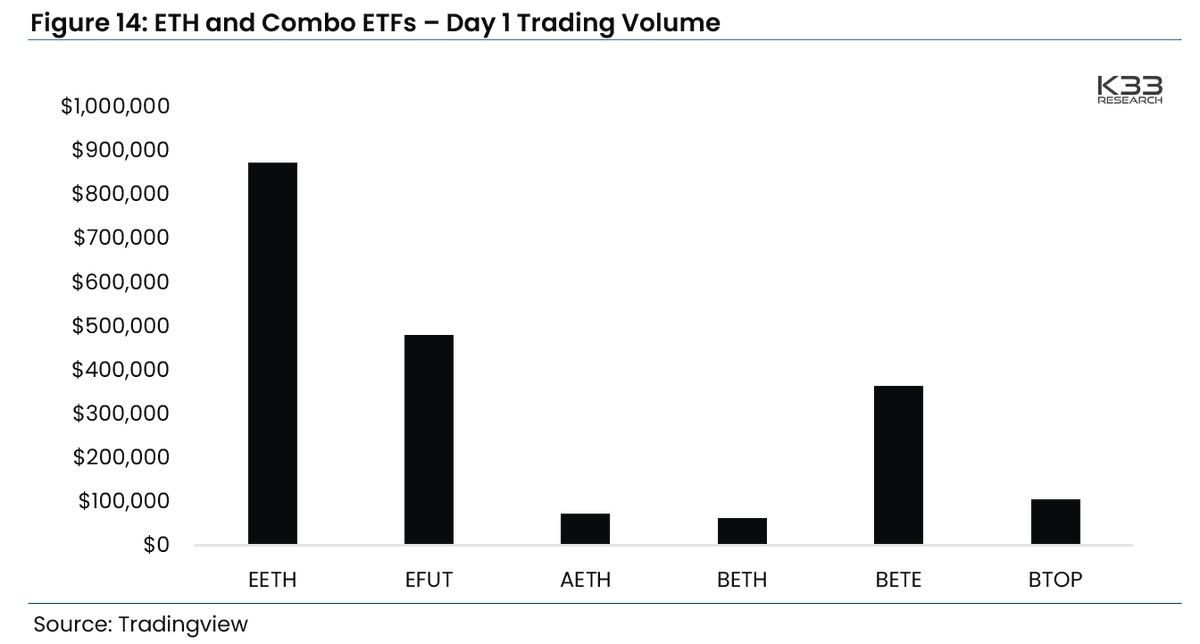

- Disappointing launch day for futures-based ETH ETFs, total trading volume: $1.96m

Some stats from the disappointing launch day for futures-based ETH ETFs.

— Vetle Lunde (@VetleLunde) October 3, 2023

Overall, the shallow flows depict a hollow market and a deficient demand for ETH exposure.

You may argue that futures-based ETFs are inferior to spot ETFs, to which I agree. This, however, does not… pic.twitter.com/76h63pbFvT

- Criminal trial date set for September 17 of 2024 for former Celsius CEO Mashinsky

- Judge rejects SEC motion to appeal Ripple ruling

- BTC cumulative volume delta (CVD) on Coinbase turned sharply positive over the past few days, indicating strong market buying

#BTC cumulative volume delta (CVD) on Coinbase turned sharply positive over the past few days, indicating strong market buying. pic.twitter.com/qQp6BTG7Fo

— Kaiko (@KaikoData) October 2, 2023

- Ripple obtains digital asset license from Monetary Authority of Singapore

- Hong Kong crypto venture capital firm CMCC Global launches $100 million fund amid industry slump

- Key takeaways from opening statements in Sam Bankman-Fried's trial over the collapse of FTX

- Since January 2023, Foundry and Antpool have collectively controlled north of 50% of Bitcoin’s hashrate, posing ever-greater centralization risk. Though Foundry’s dominance has softened to 29% from the high of 34% in February, Antpool is inching forward, gaining 5% share over the same period to reach 23%

- Firms launch El Salvador’s first Bitcoin mining pool tapping geothermal energy

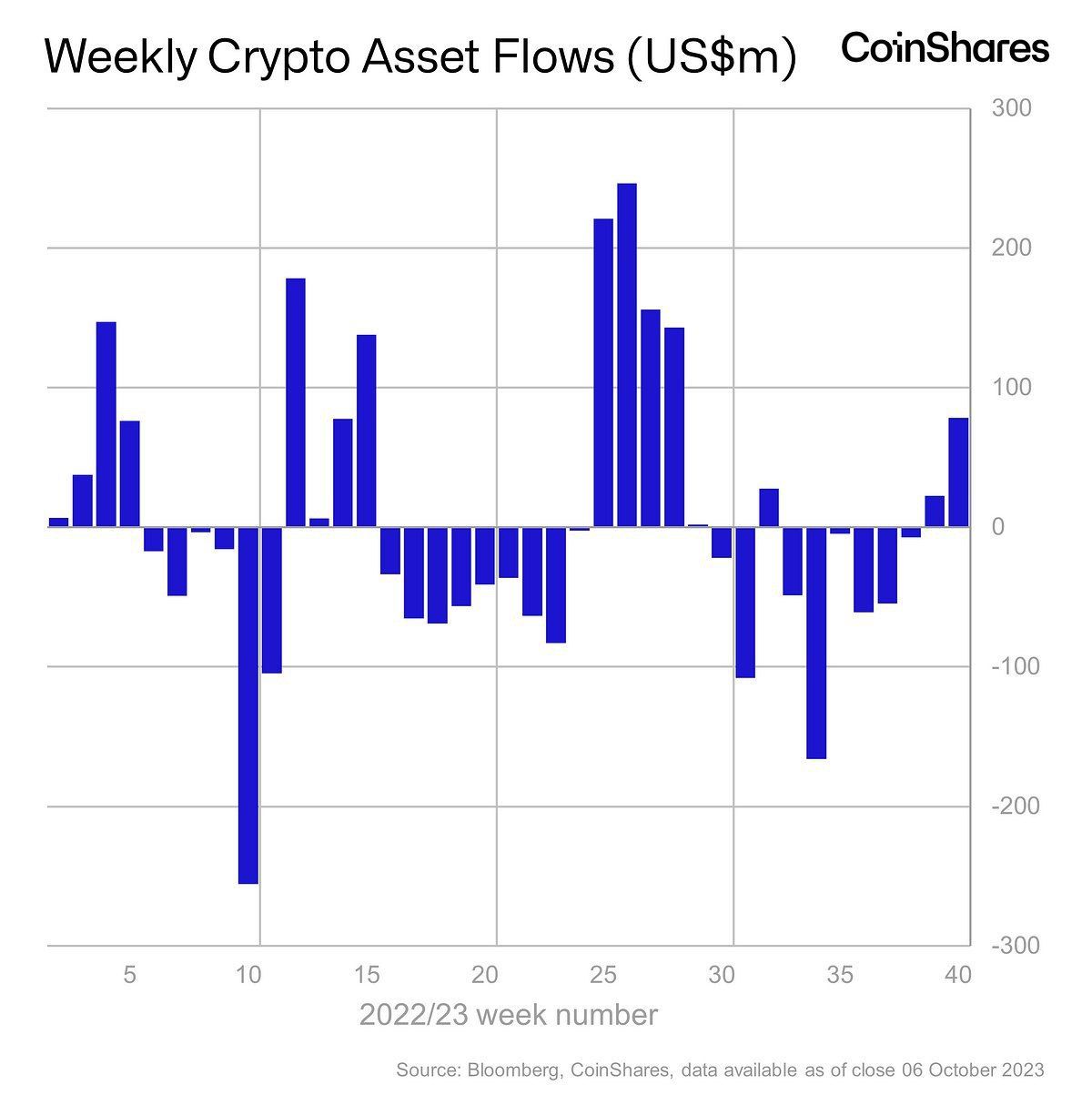

- Digital asset investment products saw inflows for the second week totalling $78m, while trading volumes for ETPs also rose by 37% to $1.13bn for the week

- Bitstamp is in talks with several big European banks about offering cryptocurrency services

- Caroline Ellison says Bankman-Fried directed her to commit crimes

AUSA: What was his involvement in the crimes?

— Inner City Press (@innercitypress) October 10, 2023

Ellison: He was the head of Alameda then FTX. He directed me to commit these crimes.

AUSA: What makes you guilty?

Ellison: Alameda took several billions of dollars from FTX customers and used it for investments.

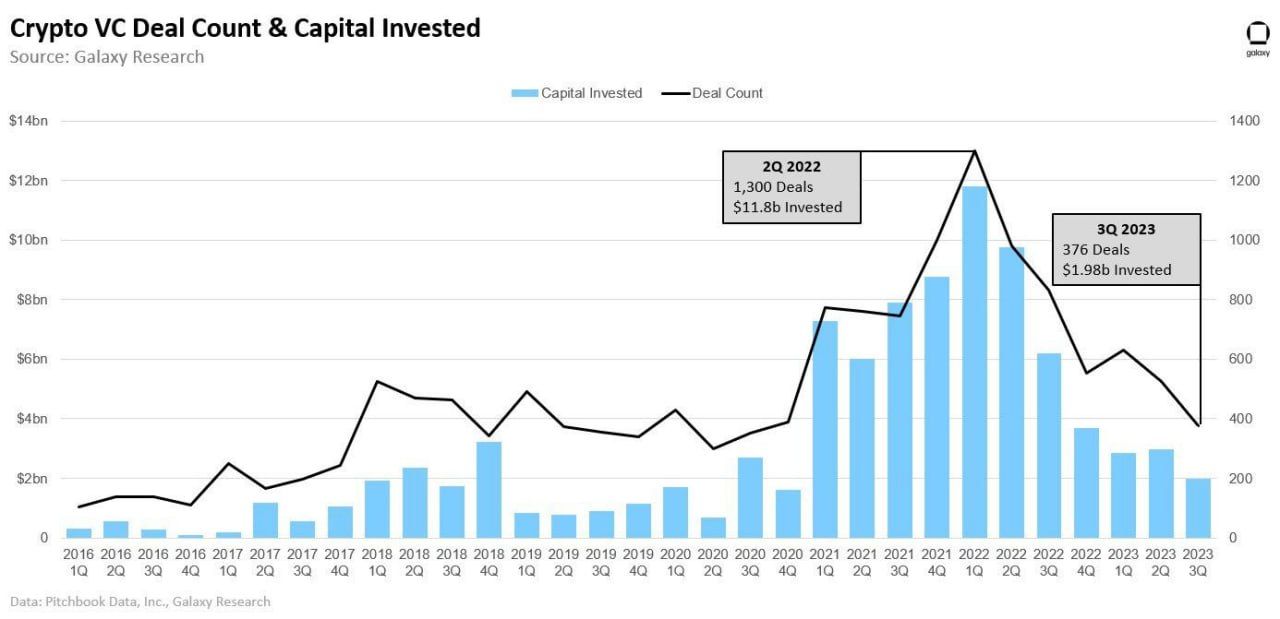

- Crypto VC activity continued to decline in Q3, with capital invested and deal count now at their lowest points since Q4 2020

Crypto VC activity continued to decline in Q3, with capital invested and deal count now at their lowest points since Q4 2020 pic.twitter.com/gXXtV3mJlB

— Galaxy Research (@glxyresearch) October 9, 2023

- Crypto exchange WOO to buy back shares from 3AC to ‘clear uncertainty’

- JPMorgan's blockchain-based collateral settlement application goes live: Bloomberg

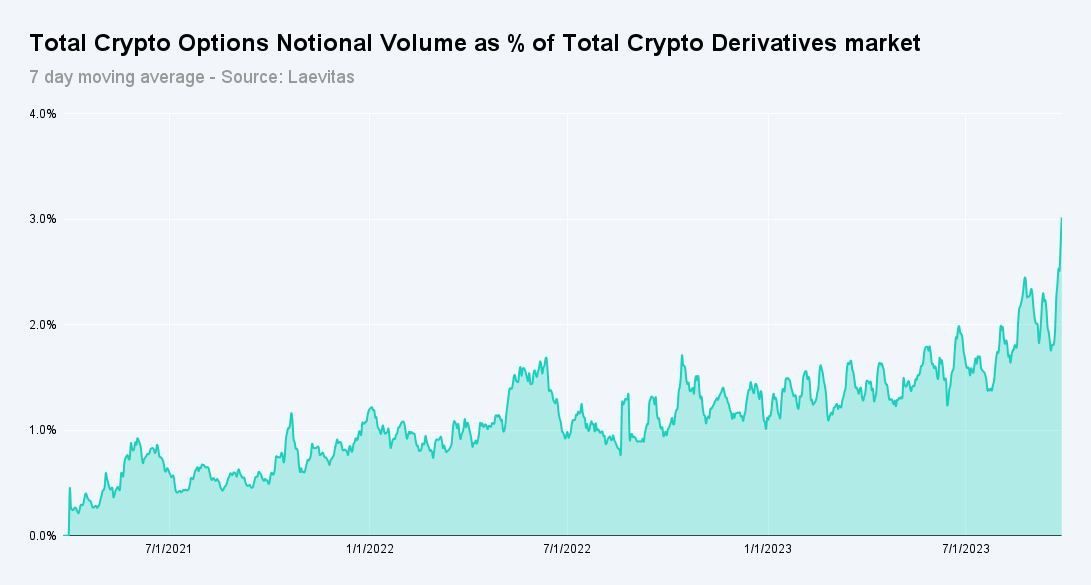

- Options volumes as a % of overall derivatives market keeps growing. The 7 day moving average reached 3% of the overall derivatives total market activity, a new all time high

Options volumes as a % of overall derivatives market keeps growing. The 7 day moving average reached 3% of the overall derivatives total market activity today, a new all time high 🚀🚀🚀. Data courtesy of @laevitas1. pic.twitter.com/a00W4IMRoM

— Deribit (@DeribitExchange) September 27, 2023

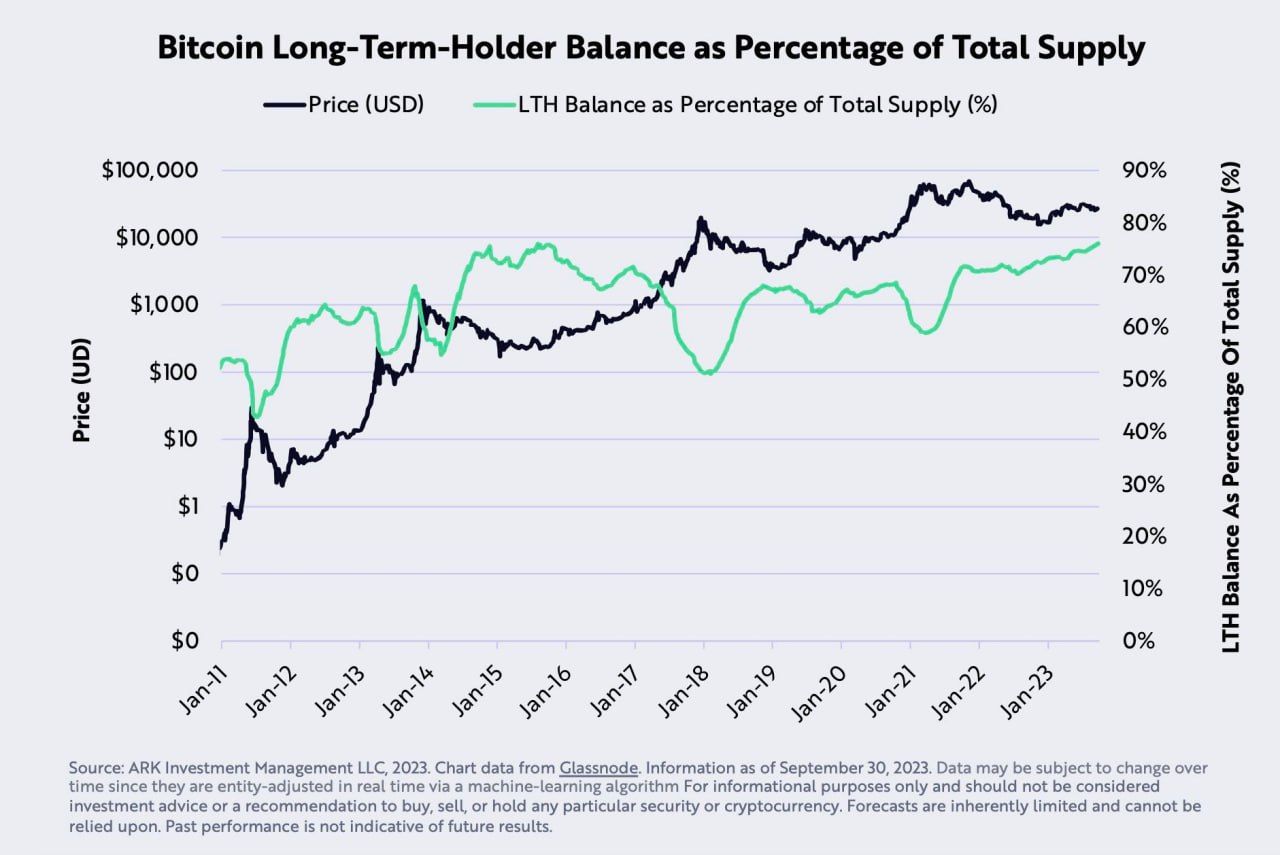

- Bitcoin long-term balances as a percent of total supply reached their highest since 2010

However, holding behavior per supply percentage held by long-term holders is at its highest high since 2010. pic.twitter.com/sRUAY2laXp

— David Puell (@dpuellARK) October 10, 2023

- Transactions on the Lightning Network have increased by more than 1212% in 2 years

3/ Chart of the day:

— Binance Research (@BinanceResearch) October 11, 2023

A recent report by @River, reported that transactions on the Lightning Network have increased by more than 1212% in 2 years. This continued to mark the shift away from Bitcoin being just a digital store of value to one that also acts as a medium of exchange. pic.twitter.com/9CjZHpMaUn

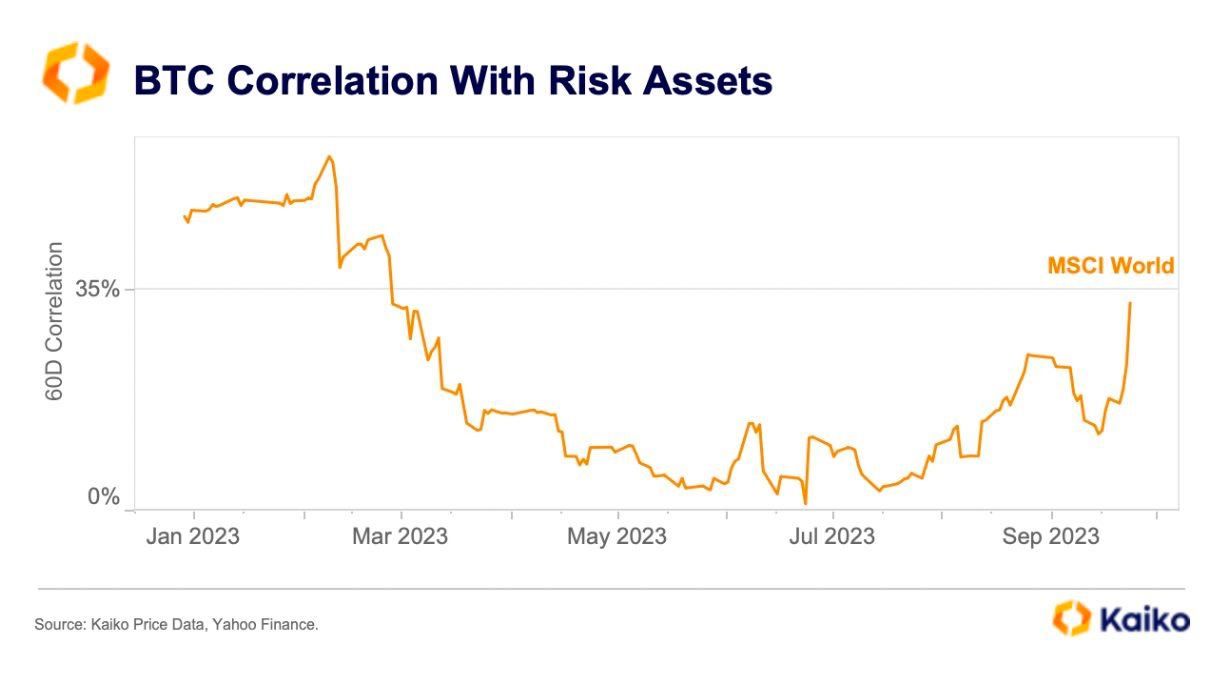

- While BTC 60-day correlation with risk assets has been moving upwards, it is way below its 2022 average of over 50%. In fact, BTC showed remarkable resilience to surging borrowing costs and growing macro uncertainty in September, outperforming the S&P 500 and the Nasdaq 100.

- Australia proposes crypto exchange regulation with existing laws

- Digital asset investment products saw inflows for the 3rd consecutive week totalling $15m, although trading volumes remain 27% below the 2023 average

- Blackrock/iShares Bitcoin spot ETF application is still under review: BlackRock via FoxBusiness

🚨BlackRock has just confirmed to me that this is false. Their application is still under review. https://t.co/XIfIWZ0Ule

— Eleanor Terrett (@EleanorTerrett) October 16, 2023

- Binance to stop accepting new U.K. users to comply with ad rules

- FTX settles customer property disputes to speed up bankruptcy proceedings, plans to return 90% of estate funds

- New York attorney general hits Gemini, Genesis, and Digital Currency Group with lawsuit for defrauding investors of more than $1 billion

- Grayscale submits new filing to SEC in attempt for spot Bitcoin ETF approval following pivotal court ruling

- US Treasury plans to designate international crypto mixers as money-laundering hubs: WSJ

- Upcoming Bitcoin spot ETF decisions. Bloomberg Intelligence estimates a 90% chance approval by Jan 10

Multiple people asking and have seen some older versions being circulated. Here's what the dates currently look like for the spot #Bitcoin ETF race pic.twitter.com/Knwun1s4Gh

— James Seyffart (@JSeyff) October 17, 2023

- Tether will publish reserve data in real time in 2024

- Digital asset investment products saw inflows for the 4th consecutive week totalling $66m. Total AuM has now risen to $33bn

- PetroChina completes first international crude oil trade in Digital Yuan: report

- Grayscale court ruling sends Bitcoin ETF approval back to SEC

Grayscale mandate dropped. Nothing new here, as expected. pic.twitter.com/KzOVQur0hI

— Scott Johnsson (@SGJohnsson) October 23, 2023

- North America’s crypto market is more driven by institutional activity than any other region’s with a whopping 76.9% of transaction volume driven by transfers of $1 million or more. The region’s on-chain activity is split relatively evenly between DeFi and centralized exchanges

- Grayscale launches crypto indices product with FTSE Russell

- Euroclear settles World Bank blockchain bond

- BlackRock’s iShares Bitcoin Trust IBTC has been removed from DTCC's list

Wait, with today's update, now the iShares Bitcoin Trust IBTC is gone from DTCC's list? @EricBalchunas @JSeyff https://t.co/r5vYkAXroW pic.twitter.com/fH9oy4ribx

— Joe Light (@joelight) October 24, 2023

- FTX is negotiating with three bidders to restart crypto exchange, firm expected to decide fate of exchange in December

- Bitfinex Securities announces tokenized bond

- Bankman-Fried lawyer says client will take stand

SBF's lawyer Cohen: We're going to put on three witnesses - then our client

— Inner City Press (@innercitypress) October 25, 2023

- UK lawmakers pass bill to help seize illicit crypto

- Kraken to share user data with IRS next month following June court order

- Gemini sues Genesis over $1.6 billion of Bitcoin Trust shares

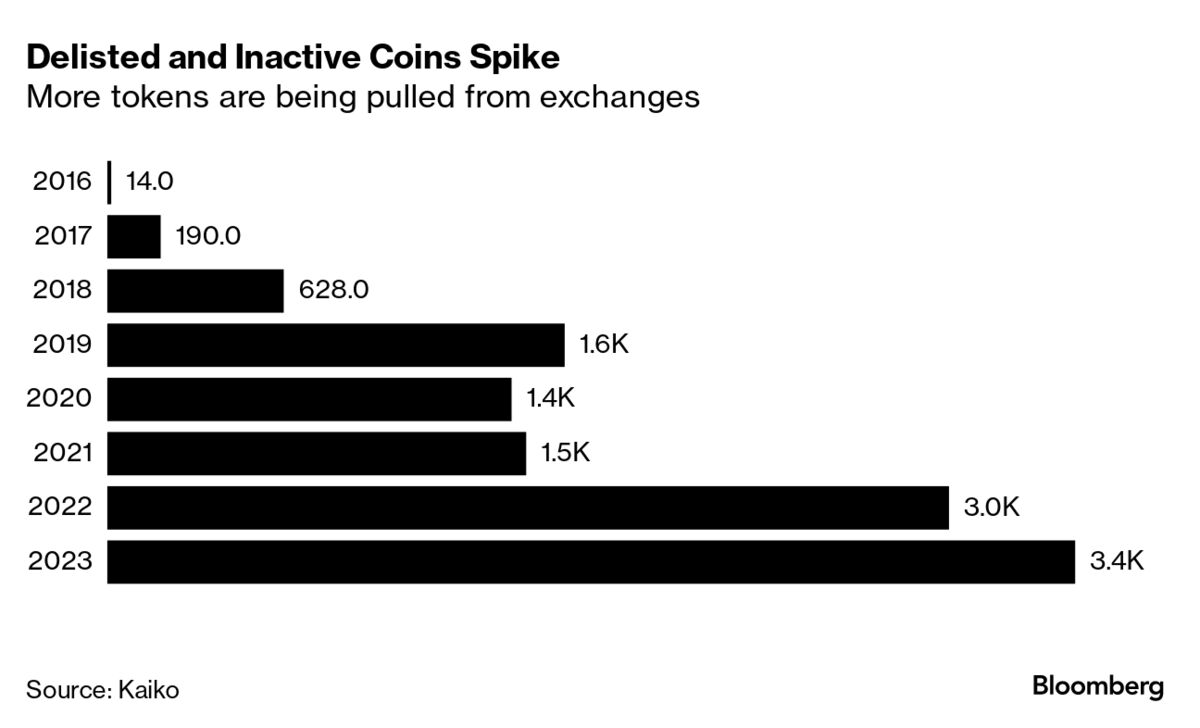

- Crypto delistings from exchanges are already running at a record pace this year

Comments ()