Will Bitcoin Succumb to Corporate Hegemony, or Will Decentralization Prevail?

In 2009, the global economy was in the grips of its most severe financial crisis since the Great Depression of 1929. The roots of this economic turmoil lay in the collaboration between major banks and risk agencies, which manipulated the American real estate market. The ensuing collapse of these large financial institutions triggered a cascading effect, leaving countless individuals deprived of their homes, jobs, and optimism.

This crisis fueled a pervasive atmosphere of distrust and resentment toward the established financial system. In response, a groundbreaking financial innovation emerged, capitalizing on the prevailing sentiment. This innovation aimed to facilitate transactions without reliance on a trusted third party, such as a central bank or financial institution. This transformative technology was none other than Bitcoin, the pioneer of cryptocurrencies.

Bitcoin's enigmatic creator, known only by the pseudonym Satoshi Nakamoto, introduced a revolutionary concept by employing blockchain technology. This distributed ledger system recorded all transactions across a network of computers, ensuring transparency, security, and decentralization.

Originally conceived as a decentralized and peer-to-peer currency, Bitcoin faced scrutiny over time. Concerns were raised about the potential centralization of mining activities and the growing influence of large corporations in the space. The approval of a Bitcoin exchange-traded fund (ETF) by the Securities and Exchange Commission (SEC) further intensified these concerns. As Bitcoin gained immense popularity, corporations like BlackRock and Fidelity, unable to thwart its rise, began to embrace and even seek to regulate it, prompting a shift in their approach from resistance to active engagement.

The question that remains is: what does the future of Bitcoin look like now that the traditional financial system is embracing it? Will it keep its innovative approach, or will it undergo drastic changes influenced by institutional involvement and mainstream adoption?

The Rising Tide of Institutional Interest

In 2014, amidst New York regulators' exploration of strategies to regulate Bitcoin, top executives from Wall Street's major banks expressed concern that regulatory measures might inadvertently legitimize cryptocurrencies, posing a potential threat to the established finance industry. In response, they embarked on a strategy to cast doubt on the credibility of cryptocurrencies.

During the World Economic Forum in Davos, Switzerland, that same year, Jamie Dimon, CEO of JPMorgan Chase, the US largest bank, labeled Bitcoin as a "terrible" store of value, asserting its association with illicit activities. Simultaneously, at a meeting addressing violations of Iran sanctions, H. Rodgin Cohen, a leading legal figure in the finance industry, cautioned state regulators that the federal government held significant apprehensions about Bitcoin and its utilization.

However, despite initial skepticism and criticism from prominent figures in the financial industry, the tide began to turn. Over the subsequent years, some of the same institutions that had once disparaged Bitcoin underwent a notable shift in perspective. It's obvious that they didn't want the rise of Bitcoin and cryptocurrencies, but they couldn't afford to lose more profits. Despite these attempts Bitcoin and other prominent cryptocurrencies had a period of intense prosperity.

A new phase of institutional interest began this year when the Bitcoin ETF was approved. Bitcoin exchange-traded Funds (ETFs) are investment funds available for public trading, offering investors the opportunity to access bitcoin (BTC) exposure without direct ownership of the cryptocurrency. In contrast to cryptocurrencies traded on dedicated crypto exchanges, these ETFs are listed and traded on traditional securities exchanges like the New York Stock Exchange and Nasdaq.

Centralization underway?

With the approval of the Bitcoin ETF, major financial institutions like BlackRock and Fidelity have bought over 134,000 BTC, valued at approximately $5.7 billion. While this development is viewed optimistically by some due to increased investment in Bitcoin, it also raises concerns.

It's crucial to remind ETF investors that owning a Bitcoin ETF is fundamentally different from owning Bitcoin itself. When purchasing a Bitcoin ETF, investors do not possess the cryptographic keys associated with the cryptocurrency. Instead, these keys are held by financial institutions. Consequently, ETF investors cannot transact with Bitcoin in the manner it was intended, which includes privacy and independence from third-party intermediaries.

Investment firms are likely to continue buying Bitcoin for the forceable future, increasing their overall position. BlackRock and Fidelity, two of the world's largest asset managers, now collectively hold 0.5% of Bitcoin's total supply, less than three weeks after launching their Bitcoin spot ETFs.

- BlackRock possesses 52,000 Bitcoins valued at $2.2 billion, establishing them as one of the largest Bitcoin holders globally.

- Fideliity holds 47,238 Bitcoins, worth $2 billion at current prices, with the asset manager accumulating at a rate of $100-$200 million per day.

It's noteworthy that BlackRock and Fidelity, despite holding significant amounts, still lack enough Bitcoin to dominate the market. However, their substantial holdings do grant them the ability to wield influence over its price.

BlackRock and Fidelity's participation in Bitcoin does not adhere to the original ethos of the cryptocurrency. Instead, their interest is predominantly driven by the potential profitability it presents. This departure from Bitcoin's decentralized principles underscores the evolving landscape of cryptocurrency adoption within traditional financial institutions.

The ongoing accumulation of Bitcoin by these companies raises concerns about the potential for increased centralization within the Bitcoin network. This trend represents a significant departure from the aspirations of the crypto cypherpunk movement, which envisioned Bitcoin as a decentralized tool capable of reshaping the trajectory of global finance and its controllers.

The Mining issue

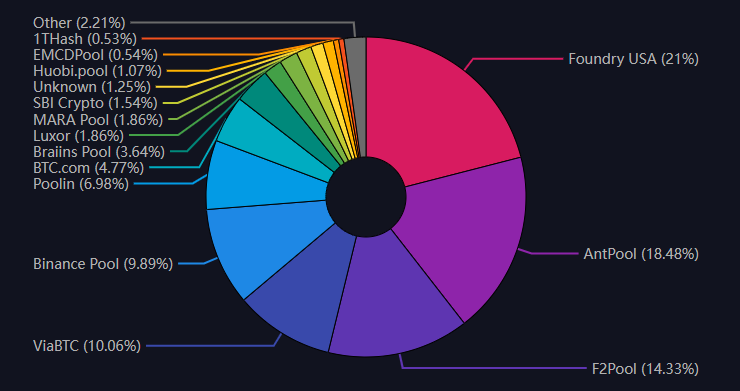

Over the past few years, there has been a discernible and steady trend towards a diminishing number of Bitcoin (BTC) mining pools exerting control over the majority of the global network's hash rate and block discovery. This concentration of power within a smaller group of mining pools has raised concerns about the potential centralization of the Bitcoin mining ecosystem.

Bitcoin miners, seeking greater predictability in the fiercely competitive realm of ASIC mining, began consolidating their hash rates by joining mining pools. This strategy enhances their likelihood of successfully mining a valid block and sharing in the block reward.

This shift has had a profound impact on the network's decentralization over the past three years. Currently, just four mining pools control over 63% of the global hash rate, indicating a significant departure from Bitcoin's originally envisioned decentralized state. Those are:

- Foundry USA (21%)

- AntPool (18.48%)

- F2Pool (14.33%)

- Binance Pool (10.06%)

Decentralization in Proof-of-work systems like Bitcoin is crucial for both financial stability and technical security. A more evenly distributed Bitcoin ownership helps mitigate the risk of market price manipulation.

When a smaller number of entities hold a significant portion of the supply or trading volume, there's a higher likelihood of manipulation. Additionally, a decentralized distribution lessens the impact of potential sell-offs by single entities, as evidenced by recent events involving F2Pool, currently the third-largest mining pool.

Furthermore, a decentralized network enhances security by making it more difficult for malicious actors to control the consensus mechanism. This mitigates the risk of a 51% attack, where an entity could potentially double spend coins, akin to using counterfeit US dollars.

Moving Forward

In conclusion, as Bitcoin continues to gain traction within traditional financial institutions and undergoes shifts towards institutional involvement, concerns about centralization loom large. The increasing accumulation of Bitcoin by major corporations like BlackRock and Fidelity, coupled with the concentration of mining power within a few select pools, challenges the decentralized ethos upon which Bitcoin was founded.

For advocates of decentralization and members of the cypherpunk movement, it's imperative to remain vigilant about these centralization trends within the Bitcoin ecosystem. While Bitcoin remains the dominant cryptocurrency in the market, it's essential to acknowledge that alternatives exist. Alternatives that are building and improving decentralised components. Alternatives that increase resilience and preserve the fundamental freedoms of peer to peer, privacy, governance and security.

Comments ()